The Kenyan Economy

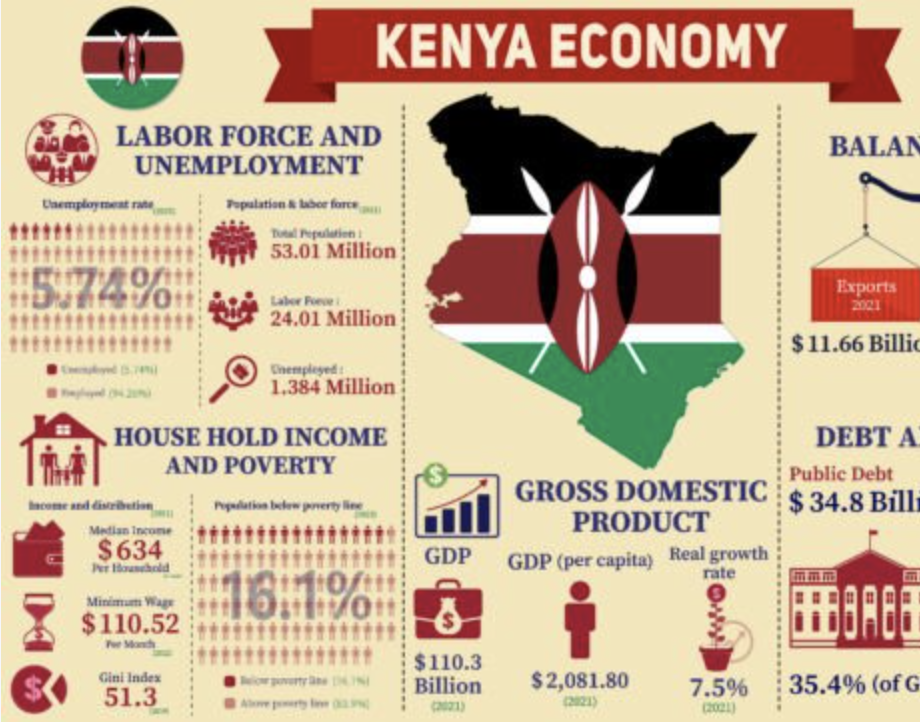

Kenya's economy, boasting a GDP of $113.42 billion in 2022, has established itself as the dominant force in East Africa. Since gaining independence in 1963, Kenya has achieved significant milestones in expanding its infrastructure and driving economic advancement.

Kenya's economy, boasting a GDP of $113.42 billion in 2022, has established itself as the dominant force in East Africa. Since gaining independence in 1963, Kenya has achieved significant milestones in expanding its infrastructure and driving economic advancement. The nation has evolved into a crucial regional financial and transportation center through strategic initiatives to attract public and private investments, setting the stage for continued and impactful growth.

In the 2019 census, the country's population was officially recorded at 47,558,296, showcasing its rich diversity and liveliness. The nation is endowed with a wide array of natural riches. These include vast fertile agricultural land, plentiful mineral deposits, diverse wildlife, and abundant water resources, such as underground aquifers, lakes, rivers, and extensive forested areas. Moreover, with a coastline extending approximately 600 kilometers, the country can actively engage in international trade and capitalize on its marine resources through fishing. This article seeks to offer in-depth insights into the development of Kenya's economic sectors, highlighting its exceptional potential for growth and progress.

The Energy Sector

Oil and Gas

Kenya relies heavily on oil and gas imports as it needs more domestic production of these resources. The country imports refined petroleum products, including diesel, petrol, kerosene, and jet fuel. Previously, Kenya possessed local oil refining capabilities, but these were lost following the neglect and subsequent collapse of the state-owned Kenya Petroleum Refineries Limited (KPRL) company. With a daily oil consumption of approximately 120,000 barrels, private oil companies, both local and foreign, fulfill the demand for oil products, including Total, Shell, Gulf Energy, Hashi Energy, Engel, and Rubis Energy. These entities play a significant role in satisfying the country's petroleum requirements.

Furthermore, Kenya has a 1,342-kilometer pipeline network linking crucial locations, including Mombasa, Nairobi, Kisumu, Nakuru, and Eldoret. Although most petroleum products are transported via trucks, a small amount is also conveyed through the rail network. Additionally, Kenya imports all its gas products, primarily for domestic and private commercial use.

Kenya's electricity generation capacity is 3,078 megawatts (MW), and the total adequate interconnected capacity in June 2022 was 2,925 MW. The peak demand in the 2021/22 financial year was 2057MW, while the average available capacity was 2035MW. Indicates a need for more reliable electricity generation capacity to meet the demand consistently. In the 1990s, Kenya allowed private or independent power producers to participate in electricity generation, moving away from total state control. This decision attracted private investment in the energy sector and led to a growth in generation capacity. Kenya uses the Kenya Power Limited Company (KPLC) to distribute electricity nationally through the national grid.

The country primarily relies on renewable sources for electricity generation. KenGen PLC, the largest power producer, has a capacity of 1904MW, mostly from renewable sources such as Geothermal (799MW), Hydro (826MW), and wind (25.5MW), with the rest being thermal. KenGen is 70% owned by the Kenyan government, and private investors own the rest. Kenya also has independent power producers, including Lake Turkana Wind Power (310MW), Rabai Power Limited (90MW), the Tsavo Power Company, IberAfrica Power East Africa Limited (52.5MW), Thika Power Limited, Triumphant Power Generating Company, Gulf Power Limited. Additionally, Kenya buys and sells electricity to its neighbors through regional grid interconnectors. However, there are reliability issues with renewable energy due to the intermittent nature of solar and wind power.

The Finance Sector

The Kenyan finance system is relatively developed compared to other Sub-Saharan African countries and other countries in terms of income level. It has the most developed financial system in the East African region. The government has numerous commercial banks, insurance companies, savings and credit cooperative organizations (SACCOs), non-bank financial institutions, and a stock exchange. Some of the most well-known banks include Equity Bank, Absa Bank (formerly Barclays), the Kenyan Commercial Bank (KCB), Cooperative Bank, Ecobank, and the Bank of Africa. Some banks, such as Equity and KCB, have expanded regionally to countries such as Tanzania, South Sudan, Rwanda, Uganda, and the Democratic Republic of Congo (DRC).

Over the past few years, Kenya's finance sector has emerged as one of the top employers, providing hundreds of thousands of well-paying jobs to the population. Banks, insurance companies, and SACCOs, among other financial institutions, employ thousands of Kenyans. In addition, employment in this sector results from the emergence of mobile money transfer and saving systems such as MPESA and Airtel Money. For instance, the country currently has over 247,869 MPESA agents who serve and employ the population nationally. Mobile money has also made it a lot easier to send money nationally, regionally, and even internationally.

The Agriculture Sector

According to the Central Bank of Kenya, the country's agriculture sector is vital to the economy, accounting for 20% of GDP. It also employs over 40% of the country's population and approximately 70% of the rural population. This implies that Kenya can still be considered to be an agrarian economy that aspires to diversify to other sectors, especially manufacturing. Most of Kenya's agriculture is small-scale producers engaged in crop and livestock farming. Despite the challenging agricultural landscape, the country boasts a multitude of large-scale producers with a focus on dairy and crop farming. Notably, the agricultural sector is predominantly driven by private producers, with limited government involvement. This dynamic underscores the significant role private entities play in shaping the country's agricultural production landscape.

Kenya's main agricultural exports are dairy products, vegetables, tea, coffee, and cut flowers. Kenya's high rainfall areas are approximately 10% of its arable land and produce nearly 70% of its commercial agricultural output. The semi-arid and arid regions produce 20% and 10% of the commercial agrarian output, respectively. The agricultural production in all regions in the country needs to be higher due to the underdeveloped support institutions and infrastructure and poor incentives. As such, Kenya faces enduring supply deficits in most of its food sectors and has to rely on imports from the EAC, COMESA, and international markets to meet its demand. The government frequently tries to alleviate these challenges by providing limited subsidies for seed and fertilizer products to help the farmers increase their production.

As a result of a lack of local production capacities, Kenya heavily relies on imports for agricultural chemicals, fertilizer, and equipment such as tractors. The country imports most of its agricultural chemicals, including fungicides, herbicides, nematicides, rodenticides, and acaricides. All fertilizers, including diammonium phosphate, potassium phosphate, calcium ammonium nitrate, and urea, are imported mainly from Russia, the USA, China, Romania, and Ukraine. Since the 1990s, the nation's fertilizer consumption has nearly doubled following the liberalization of the market. Today, almost all farmers in the country utilize fertilizer in agricultural production, demonstrating the widespread adoption of this essential practice.

The Communication Sector

Kenya has one of the most developed communication sectors in Sub-Saharan Africa. The country's communication sector accounts for approximately 8% of the country's GDP. Its 3G and 4G networks now cover over 96.3% of the country, meaning that almost all citizens can access communication and internet services. Kenya is considered the region's ICT hub because it leads in broadband connectivity, mobile money and banking, general ICT infrastructure, and FinTech Services. Internet connectivity has played a vital role in the growth of the nation's economy, especially since most of the population has access to smartphones and computers. The leading companies in the sector include Safaricom, Telkom, and Airtel, which compete against each other in the market. Nonetheless, it is essential to note that the country relies on imports for the electronics, hardware, and software used in the sector from countries such as China, the United States, South Korea, and Japan.

The Transport Sector

Kenya has a relatively well-developed transport sector comprising all modes of transport: sea, air, road, and rail. The industry also includes related services such as warehousing, packaging, assembling, handling, and stevedoring. The country has a Road Network inventory of approximately 177,500 kilometers comprising 63,000 classified roads and 114,500 unclassified roads, which various government departments administer. Over 80% of the country's passenger and freight transportation is based on the road network, and the transport network is dominated by private companies, both large and small. In addition, Kenya has 38 airports that cater to domestic and international flights. Its railway network is approximately 3,819 kilometers long and was primarily developed in the colonial era. In the modern era, Kenya has only built 609 kilometers of rail through the standard gauge rail (SGR) project from Mombasa to the hinterland.

The Manufacturing Sector

Kenya has a relatively large manufacturing sector, which contributed to 7.83% of its GDP in 2022. The industry is diverse and comprises various sub-sectors, including plastics, cement, automotive, metals, dairy, manufacture of alcoholic beverages and other food products. The nation also has apparel and textile manufacturing industries that serve local, regional, and international markets. The manufacturing sector has thrived over the past decade but slowed to 2.7% in 2022. Most of the equipment used in the manufacturing sector is imported from countries such as Germany, China, the United States, South Korea, Japan, and South Africa, among others. Although the country has a large manufacturing industry, it mainly comprises primary and light industries. The government does not have significant advanced or heavy manufacturing industry capabilities and has to rely on other countries for many of the needed manufactured products.

Challenges Facing the Kenyan Economy

Unemployment

Like many African countries, Kenya has a very young population with a median age of 20.1 years. The country is struggling to provide jobs to its youthful population, which is entering the labor market at a rapid pace. Its youth unemployment rate is 13.35%, and a significant part of the young people are also underemployed. As such, Kenya is a large labor exporter, with many young people moving to countries such as Saudi Arabia, Qatar, the United States, Canada, Germany, and the UK, among others, for better-paying jobs. The high youth unemployment rates can be problematic, leading to increased crime rates, hopelessness, and drug abuse among young people. Nonetheless, the fact that Kenya has a well-developed education system means that most young people have the knowledge and skills to engage in income-generating activities, especially in the informal sector.

High energy prices

Unfortunately, Kenya has high energy prices, which have only increased over the past few years. The high prices can be primarily attributed to high taxation, high fuel costs, and the weakening Kenyan shilling. The cost of energy affects all aspects of the economy, including the manufacturing sector, which means that high energy prices also lead to higher costs of goods for the population. In addition, high energy prices also deter investment in the economy, especially for foreign investors who may prefer investing in neighboring countries with lower prices. In addition, Kenya still has limited energy generation capacity, given that it is a large nation with over 50 million people. That said, the government also takes some mitigating steps, including encouraging manufacturers to manufacture at night when the electricity demand is lower, thus enabling them to work at lower costs.

High Taxes

Although Kenya is the most developed economy in East Africa, it is also among the highest-taxed countries in the region. The high taxes can be attributed to high government spending on both the county and national governments, high levels of national debt, increased budget deficits, and the need for public expenditure on infrastructure projects. While raising funds for the government is necessary, high taxation reduces the economy's attractiveness to foreign and domestic investment. Kenya is part of the East Africa Community common market, so investors can always prefer other countries with more friendly taxes in the region and still access the Kenyan market. High taxes in Kenya have also made the cost of petrol, diesel, and electricity the highest in East Africa.

Corruption

Unfortunately, corruption has remained endemic in Kenya since independence and has negatively affected the economy and the population. The corruption in Kenya mainly involves government officials and corrupt businessmen who plot and scheme to embezzle public funds for their personal use. Throughout the country, citizens complain that corruption often leads to poor government services, incomplete or substandard infrastructure projects such as roads, and a neglect of public services such as public schools and hospitals.

References

Kirimi, P. N., Kariuki, S. N., & Ocharo, K. N. (2022). Financial soundness and performance: evidence from commercial banks in Kenya. African Journal of Economic and Management Studies, 13(4), 651-667.

Macharia, K. K., Gathiaka, J. K., & Ngui, D. (2022). Energy efficiency in the Kenyan manufacturing sector. Energy Policy, 161, 112715.

Misati, R., Osoro, J., Odongo, M., & Abdul, F. (2022). Does digital financial innovation enhance financial deepening and growth in Kenya? International Journal of Emerging Markets.

Mose, N. G. (2022). Fiscal decentralization and economic growth: The Kenyan experience. Journal of Somali Studies, 9(2), 59.

Nyoro, J. K. (2019). Agriculture and rural growth in Kenya. Tegemeo Institute.

Odhiambo, N. M. (2022). Foreign direct investment and economic growth in Kenya: An empirical investigation. International Journal of Public Administration, 45(8), 620-631.

https://www.privacyshield.gov/ps/article?id=Kenya-Information-Communications-and-Technology-ICT